The CBI has registered a corruption case against Congress MP Karti Chidambaram, the son of former finance minister P Chidambaram, accusing him of receiving “suspicious” fund transfers from liquor company Diageo as well as venture capital fund Sequoia Capital, the agency said in a statement.

It also booked Advantage Strategic Consulting Pvt Ltd (ASPCL) — an entity controlled by Karti and his aide S Bhaskararaman — besides Diageo Scotland, Sequoia Capital Mauritius and Vasan Healthcare Pvt Ltd on January 1 after receiving a complaint from CBI inspector Ravi Raj Khatik.

Karti was unavailable for comment.

“A preliminary enquiry was registered on May 29, 2018 against M/s Katra Holdings Ltd, Mauritius, M/s Advantage Strategic Consulting Pvt Ltd, Karti P Chidambaram, Ravi Vishwananthan, Padma Vishwananthan, S Bhaskararaman, unknown public servants of Foreign Investment Promotion Board (FIPB) and unknown others to probe into the processing and approval of FIPB,” Khatik alleged in the complaint, which is a part of the FIR.

The FIR said Diageo and Sequoia Capital were found to have “suspiciously transferred funds to ASPCL”.

“Enquiry revealed M/s Diageo Scotland, UK used to import duty free Johnnie Walker whisky and, the India Tourism Development Corporation (ITDC), which had a monopoly over sale of imported duty-free liquor in India, in 2005 had put an embargo on the sale of the Diageo Group’s duty-free products in India which resulted in huge loss to M/s Diageo Scotland as 70% of its business in India pertained to the sale of Johnnie Walker whisky,” it said.

The complaint alleged that to lift the ban, Diageo Scotland approached Karti and paid him $15,000 through ASCPL “for influencing public servants for lifting the ban imposed on M/s Diageo Scotland for sale of duty-free liquor and not for any consultancy work”.

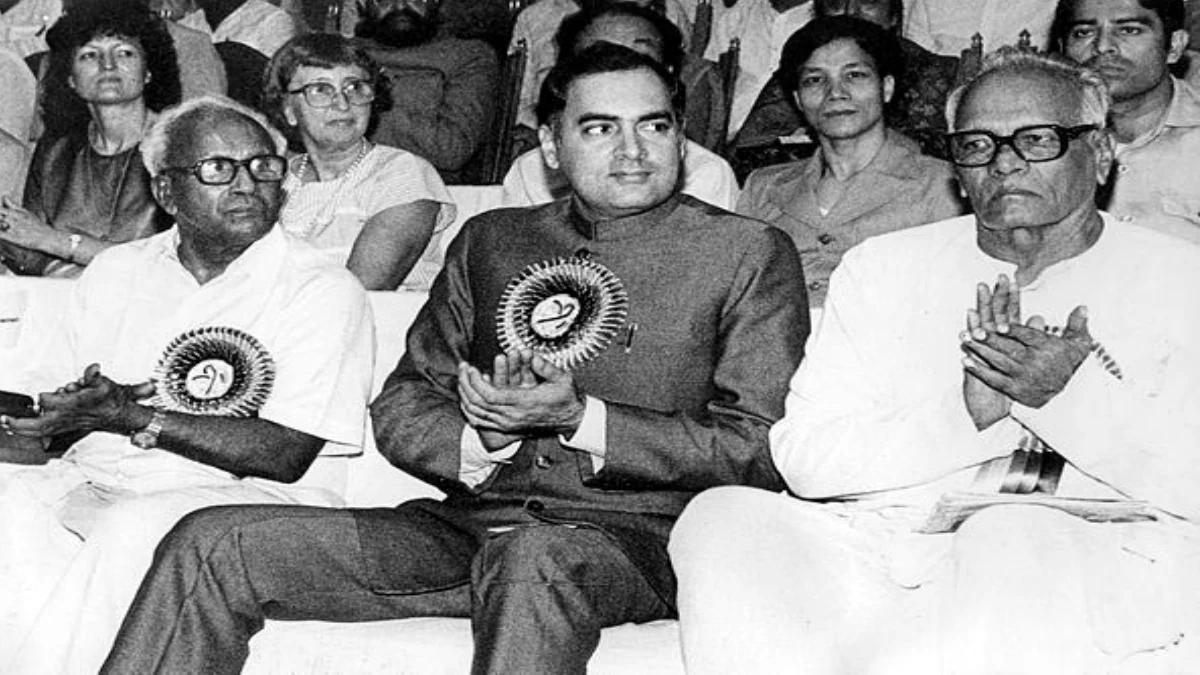

Separately, according to the FIR, Sequoia Capital, Mauritius, had submitted an application for FIPB approval on October 13, 2008 for investing up to 26% in the share capital of Platinum Power Wealth Advisor Pvt. Ltd. The FIPB approval for FDI inflow of `9.52 crore was approved by P Chidambaram, the then the Finance Minister, in 2008, the agency said.

“Enquiry also revealed that at the time when the FIPB proposal of Sequoia Capital for FDI was moved, some suspicious share transactions at exorbitant price took place between Sequoia Capital and ASCPL through Vasan Health Care Pvt. Ltd. Instead of directly acquiring the shares of M/s Vasan group, the shares were routed through ASCPL in order to benefit Karti as a total of `22.50 crores was paid by Sequoia to M/s ASCPL (Rs 7,500 per share) in lieu of these shares as against the purchase price of `30 lakh,” the FIR said.

Stay informed with access to our award-winning journalism.

Avoid misinformation with trusted, accurate reporting.

Make smarter decisions with insights that matter.